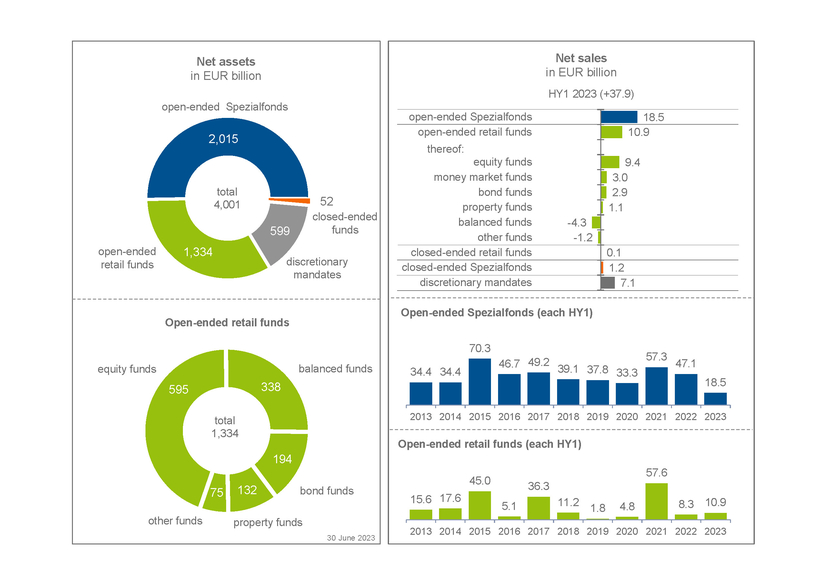

Half-year figures: fund industry raises EUR 38 billion in Germany

- Retail funds: higher inflows than HY1 2022

- Equity funds on top of sales list

- Property funds: more residential and warehouses

In Germany, the fund industry received a net inflow of EUR 38 billion in the first half of the year. While net sales of retail funds increased from EUR 8.3 to EUR 10.9 billion compared to the same period last year, institutional investors held back on new investments in Spezialfonds. These funds recorded EUR 18.5 billion from the beginning of January to the end of June. In the first six months of 2022, they attracted EUR 47.1 billion. In terms of assets, Spezialfonds remain the largest group with EUR 2,015 billion. They are followed by open-ended retail funds with EUR 1,334 billion, mandates with EUR 599 billion and closed-ended funds with EUR 52 billion. At mid-year, the fund industry managed a total of EUR 4,001 billion for institutional and private investors in Germany. This is five percent more than at the beginning of the year (EUR 3,805 billion).

The sales list of open-ended retail funds is headed by equity funds. They received EUR 9.4 billion in the first half of the year. Of this, EUR 5.3 billion is accounted for by actively managed funds and EUR 4.1 billion by ETFs. Money market funds are the second strongest group with EUR 3.0 billion. Their new business usually varies strongly compared to other funds. For example, they received around EUR 5 billion in the second quarter, after outflows of just under EUR 2 billion in the first quarter. Bond funds recorded inflows of EUR 2.9 billion this year. New business was dominated by funds focusing on corporate bonds. They attracted EUR 2.7 billion. Property funds received net inflows of EUR 1.1 billion from the beginning of January to the end of June. Balanced funds recorded outflows of EUR 4.3 billion in the first half of the year. After many years of high inflows, the trend from the second half of 2022 continued in this group, when net outflows of EUR 3.8 billion were recorded.

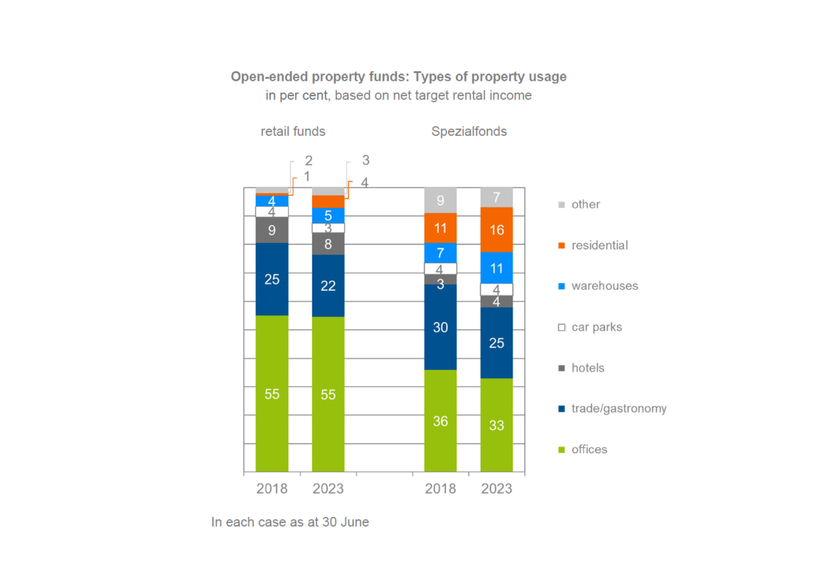

Property funds manage EUR 309 billion

The net assets of property funds have risen from EUR 182 billion (end of June 2018) to EUR 309 billion over the past five years. Open-ended Spezialfonds account for EUR 159 billion, open-ended retail funds for EUR 132 billion and closed-ended funds for EUR 18 billion.

An analysis of open-ended property funds shows that Spezialfonds and retail funds have increased the share of residential and warehouse properties in the last five years. Residential properties now account for 16 instead of 11 percent of net target rental income in Spezialfonds and 4 instead of 1 percent in retail funds. In particular, the share of trade and gastronomy has fallen. Offices are still the main type of usage of the properties in the portfolios.