Germany: Fund industry grows by 5 per cent

- Retail funds and Spezialfonds attract inflows

- Equity funds clearly lead net sales

- Spezialfonds: decline in bond ratio slows down

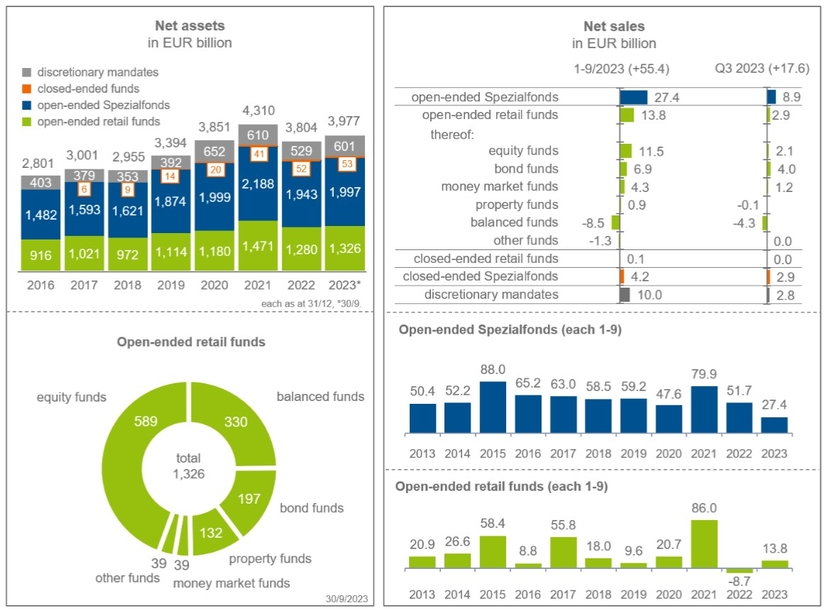

Fund companies had a total of EUR 3,977 billion AuM for investors in Germany at the end of September. This is an increase of some 5 per cent since the beginning of the year (EUR 3,804 billion). At EUR 1,997 billion, the majority is accounted for by open-ended Spezialfonds for institutional investors. This primarily includes retirement benefit schemes (EUR 684 billion) and insurance companies (EUR 522 billion). The fund companies have EUR 1,326 billion AuM in open-ended retail funds, EUR 601 billion in mandates and EUR 53 billion in closed-ended funds.

In the first nine months of the year, the industry saw a net inflow of EUR 55.4 billion. EUR 13.8 billion of this was attributable to open-ended retail funds, which recorded in the same period last year in view of the market turbulence caused by the Ukraine war outflows of EUR 8.7 billion. Equity funds lead the sales list in the year to date with EUR

11.5 billion. In the same period last year, EUR 1.7 billion of outflows were recorded from these funds. At the end of September 2023, fund companies had a total of EUR 589 billion under management in equity funds. There was also a turnaround in new business for bond funds. After outflows of EUR 12.4 billion by the end of September 2022, they recorded net new money of EUR 6.9 billion in the first nine months of 2023. Their new business is dominated by funds with a focus on corporate bonds (EUR 3.2 billion). The assets of all bond funds amounted to EUR 197 billion. Money market funds follow in the sales list with inflows of EUR 4.3 billion, after outflows of EUR 9.5 billion in the comparable period of the previous year. Their assets amounted to EUR 39 billion. New business in property funds declined in the current year. After inflows of EUR 0.7 billion in the first quarter and EUR 0.3 billion in the second quarter, they recorded outflows of EUR 0.1 billion in the third quarter. They last recorded outflows in the fourth quarter of 2016 (EUR 0.4 billion). Property funds manage net assets of EUR 132 billion. The outflows from balanced funds continued. By the end of September, they reached EUR 8.5 billion. Of this amount, EUR 4.6 billion are attributable to funds with large bond exposure, EUR 3.3 billion to funds with moderate bond exposure and EUR 0.6 billion to funds with large equity exposure. In total, balanced funds have assets of EUR 330 billion.

Open-ended Spezialfonds recorded inflows. At EUR 27.4 billion, their new business up to the end of September 2023 is significantly lower than in the same period of the previous year, when Spezialfonds received EUR 51.7 billion. In addition to higher liquidity requirements, uncertainty about the development of interest rates and inflation is apparently holding many investor groups back from investing.

The portfolio allocation of Spezialfonds has changed in recent years. According to the Bundesbank, the proportion of bonds has fallen from 59 per cent in June 2013 to 43 per cent in June 2022. In light of the

return of interest rates, it has now increased to 44 per cent. The funds are investing more in equities, which account for 15 per cent of investments. Ten years ago, this figure was just under 13 per cent. Spezialfonds are also increasingly using other funds, such as ETFs, to diversify their investments and implement their investment strategy more easily. Target funds account for 28 per cent of the assets of open-ended Spezialfonds. The share of other assets has also grown, including illiquid investments such as real estate and infrastructure investments.