- Robust new business despite market turbulence

- Sales of balanced funds remain strong

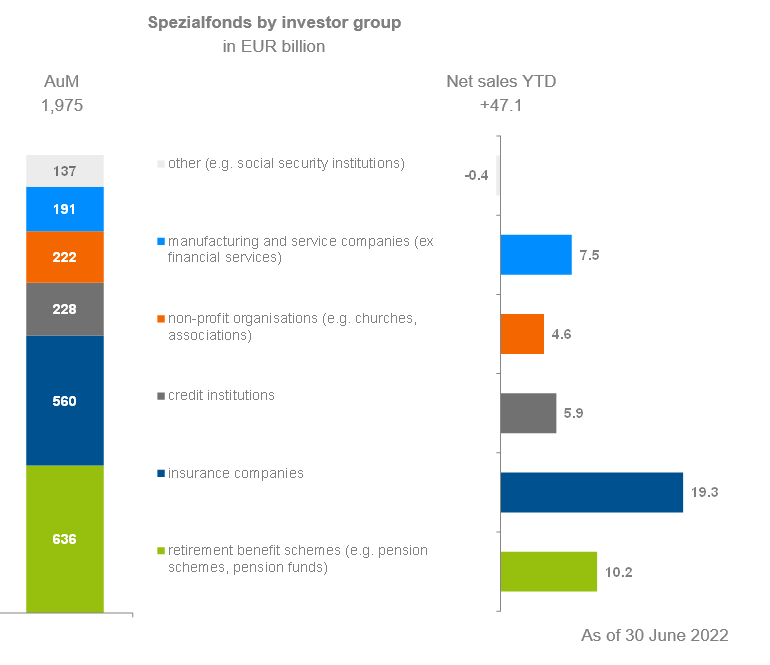

- Spezialfonds with AuM of 1,200 billion EUR for retirement benefit schemes and insurers

In Germany, investment funds and mandates recorded inflows of EUR 52 billion in the first half of 2022. This is the fifth-best sales result. The industry recorded higher inflows in the same period in 2021 (EUR 111 billion), 2015 (EUR 110 billion), 2017 (EUR 78 billion) and 2000 (EUR 54 billion).

Open-ended retail funds and Spezialfonds started in January 2022 with record sales of total more than EUR 30 billion. As the year proceeded, monthly inflows reduced in the face of market turmoil due to the Ukraine war and high inflation. In June, there were net outflows of EUR 0.3 billion from open-ended funds. The last time they recorded outflows was in March 2020, when redemptions totalled EUR 12 billion.

Balanced funds with inflows, outflows from money market and bond funds

In terms of retail fund sales, the signs turned in the ongoing year. After inflows of EUR 14.1 billion in the first quarter, they recorded outflows of EUR 5.5 billion in the second quarter. In June, investors withdrew more than EUR 5 billion. In the first half of the year, new business was characterised by strong inflows into balanced funds on the one hand and outflows from money market funds and bond funds on the other. Balanced funds raised EUR 16.3 billion in new money. This is a follow-up to the previous year, with balanced funds registering EUR 16.9 billion in the same period. By total outflows of EUR 13 billion in the year to date, money market funds and bond funds negatively impacted sales of retail funds. In 2021, inflows into bond funds (EUR 1.5 billion) and outflows from money market funds (EUR 1 billion) had almost balanced each other out by the end of June. New business from equity funds has fallen significantly in 2022 due to the stock market turbulence. They attracted over EUR 5 billion in new money, almost all of it in actively managed funds. In the first half of 2021, equity funds raised EUR 35.4 billion, of which close to half was in equity ETFs.

While the German market recorded inflows until the end of June 2022, UCITS launched in Europe recorded outflows totalling EUR 145 billion, according to Morningstar. This was mainly due to redemptions of money market funds (EUR 108 billion) and bond funds (EUR 85 billion). In contrast, balanced funds, and equity funds, for example, raised EUR 26 billion and EUR 19 billion, respectively.

Spezialfonds sales: Insurers surpass retirement benefit schemes

The German fund industry had assets of EUR 3,859 billion at the end of June 2022. Open-ended Spezialfonds account for EUR 1,975 billion, open-ended retail funds for EUR 1,303 billion, closed-ended funds for EUR 48 billion and mandates for EUR 533 billion. Among Spezialfonds, retirement benefit schemes are the largest investor group by volume with EUR 636 billion; this includes, for example, occupational pension funds. Insurance companies have invested EUR 560 billion in Spezialfonds. The two groups together account for 61 percent of total assets. As these figures once again clearly show, the asset management industry is of great importance to retirement planning in Germany. Insurance companies and retirement benefit schemes are also in the lead in terms of new business, with inflows totalling almost EUR 30 billion. This year, it is the insurers who have invested the largest amount of new money in Spezialfonds by the end of June. This is probably because they have shifted direct investments into Spezialfonds. In the six years before, retirement benefit schemes were the sales driver.