Fund industry with remarkable sales in Germany in the first quarter

- Equity funds with second-best start to the year since 2015

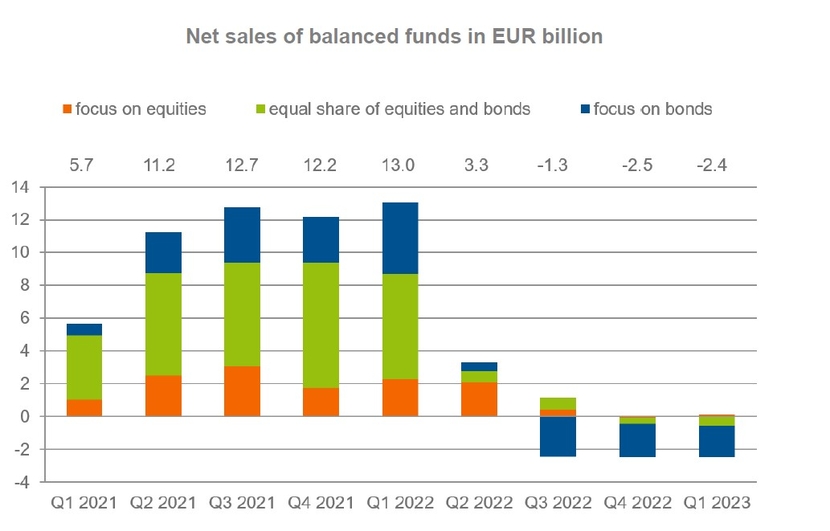

- Balanced funds continue with outflows

- Assets up 30 per cent in five years

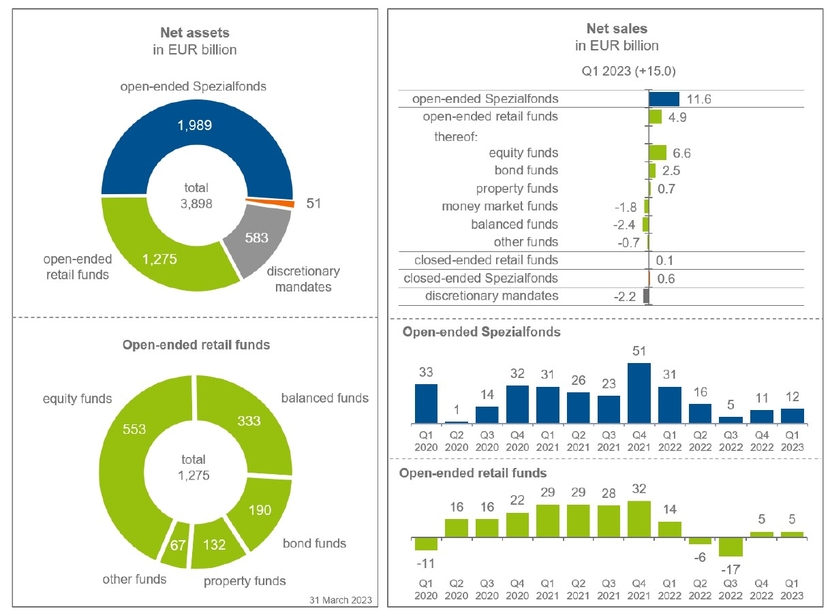

In the first quarter of 2023, the fund industry in Germany recorded net inflows of EUR 15 billion. This is a remarkable sale given the stagnating economic growth. Open-ended Spezialfonds are again the driver of new business with EUR 11.6 billion. These funds are held by institutional investors such as insurers and pension funds, which invest their clients' regular premium payments in Spezialfonds. Open-ended retail funds received EUR 4.9 billion. Closed-end funds recorded EUR 0.7 billion in new money. Investors withdrew EUR 2.2 billion from discretionary mandates.

Among the open-ended retail funds, equity funds led the way with inflows of EUR 6.6 billion. This is the second-best start to the year since 2015 (EUR 7.1 billion by the end of March). Higher sales were only recorded in the first quarter of 2021 (EUR 22.1 billion). Currently, globally investing funds were in particular demand (EUR 6.1 billion).

Bond funds achieved inflows of EUR 2.5 billion from the beginning of January to the end of March 2023 – after four quarters of outflows. Thereof, funds with a focus on corporate bonds accounted for EUR 1.9 billion. Property funds recorded EUR 0.7 billion in new money. EUR 2.4 billion were withdrawn from balanced funds. Bond-focused funds (EUR 1.9 billion) were the main drivers. Balanced funds have recorded net outflows since mid-2022.

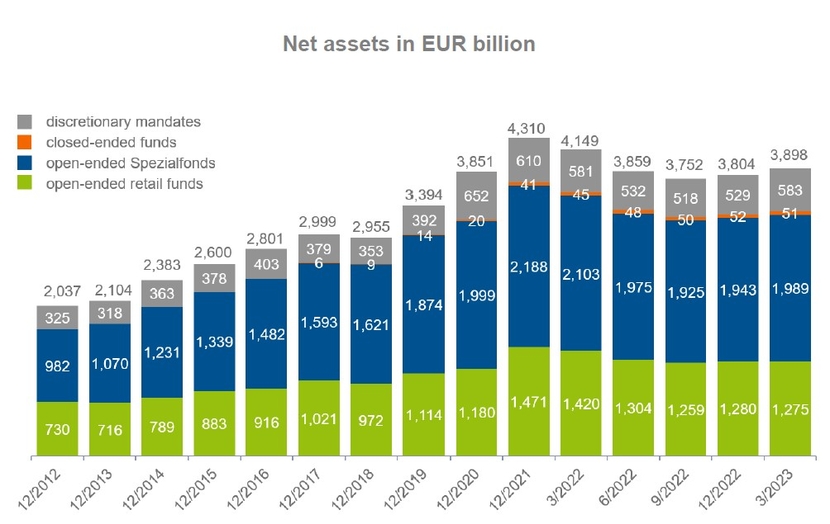

Fund companies manage a total of EUR 3,898 billion for investors in Germany. Assets have increased by 30 per cent in the last five years. At the end of March 2018, it was EUR 2,985 billion.

Each as of end of month

At EUR 1,989 billion, a large part of the assets is attributable to the institutional business with open-ended Spezialfonds. Pension funds with EUR 675 billion and insurance companies with EUR 538 billion are the two largest investor groups.

Open-ended retail funds manage EUR 1,275 billion. Equity funds account for EUR 553 billion. Their share rose from 36 to 43 percent in the last five years. Next in line are balanced funds with EUR 333 billion. In 2015, they took over second place from bond funds, which manage EUR 190 billion. The net assets of property funds amount to EUR 132 billion.

In closed-ended funds, the BVI statistics show assets of EUR 51 billion. EUR 583 billion are managed by the fund companies in discretionary mandates outside funds.

Download Press release

To Statistic